Bond Tap Issue of € 29,000,000 on their €101,000,000 April-2027 5.80% senior unsecured bond

€29m tap issue on the April-2027 5.80% €101m senior unsecured bond of SACYR. Total bond final amount of €130m.

Loading

Content

The current content does not exist in the language you had selected.

Bond Tap Issue of € 29,000,000 on their €101,000,000 April-2027 5.80% senior unsecured bond

€29m tap issue on the April-2027 5.80% €101m senior unsecured bond of SACYR. Total bond final amount of €130m.

Public Bond & Exchange Offer

On the 24th of April 2024, Sport Lisboa e Benfica – Futebol, SAD concluded a €50,000,000 public bond issue (“Benfica SAD 2024-2027”), through a subscription offer in the amount of €32.7 million, and an exchange offer on the outstanding “Benfica SAD 2021-2024” bonds, in the amount of €17.3 million. Final demand reached €67.6 million, i.e. 1.35x of the issued amount.

The new bonds have a fixed rate coupon of 5.10% p.a., payable semi-annually, and a 3-year maturity.

Haitong Bank acted as Sole Global Coordinator in this transaction and is also the paying agent.

Technical Listing

On the 19th of April 2024, 134.990.453 class A shares with a nominal amount of €1,00 each, representative of 66,83% of the share capital of Sporting Clube de Portugal – Futebol, SAD, were admitted to trading on the regulated market of Euronext Lisbon. The new shares result from the conversion of VMOCs (valores mobiliários obrigatoriamente convertíveis), and following admission, will be fungible with the shares that represent the share capital of Sporting SAD, that are already admitted to trading.

Haitong Bank acted as Advisor in this transaction.

Public Bond & Exchange Offer

On the 27th of March 2024, Sporting Clube de Portugal – Futebol, SAD concluded a €50 million public bond issue ("Sporting SAD 2024-2027"), through a subscription offer in the amount of €30 million, and an exchange offer on the outstanding "Sporting SAD 2021-2024" bonds, in the amount of €20 million. Final demand reached €66.4 million, i.e. 1.33x of the issued amount.

The new bonds have a fixed rate coupon of 5.75% p.a., payable semi-annually, and a long 3-year tenor, maturing on the 26th of November 2027.

Haitong Bank acted as Sole Global Coordinator in this transaction and is also the paying agent.

5.2% Bonds due 2027

Haitong Bank's Macau Branch acted as Joint Global Coordinator, Joint Lead Manager and Joint Bookrunner of Sanming City Construction and Development Group Co., Ltd.'s CNY 410 million bond issue, with a coupon of 5.2% and a 3-year tenor.

The net proceeds from the Bonds are intended to be used for Project construction and replenishing working capital.

7.50% Bonds due 2027

Haitong Bank's Macau Branch acted as the Joint Lead Manager and Joint Bookrunner of Chengdu Yunlai Investment Group Co., Ltd.'s USD 70 million bond issue, with a coupon of 7.5% and a 3-year tenor with guarantee by Tianfu Bond Insurance Co., Ltd.

The Issuer intend to use the proceeds from this offering for developing businesses of the Issuer Group and replenishing working capital.

7.70% Bonds due 2026

Haitong Bank's Macau Branch acted as the Joint Global Coordinator, Joint Lead Manager and Joint Bookrunner of Chengdu Jingkai Asset Management Co., Ltd's CNY 300 million bond issue, with a coupon of 7.7% and a 2-year tenor.

The Issuer intend to use the proceeds from this offering for the Group's general working capital.

7.5% Green Bonds due 2027

Haitong Bank's Macau Branch acted as Joint Lead Manager and Joint Bookrunner of Ji'An Chengtou Holding Group Co., Ltd.'s USD 173.68 million bond issue, with a coupon of 7.5% and a 3-year tenor.

The net proceeds from the Bonds are intended to be used for financing or refinancing existing indebtedness in accordance with the Group's Green Finance Framework and the NDRC Certificate.

Sale of a Solar PV Plant

(25 MW)

Haitong acted as exclusive financial adviser to the France-based asset manager Mirova in the sale of a 25MW Solar PV plant in Évora (south of Portugal).

The Solar PV plant, commissioned in 2019, operates under a pay-as-produced PPA agreement with a reputable offtaker.

Loan Facility

Haitong Bank's Warsaw Branch, acted as Sole Arranger of a credit facility with RCI Banque S.A. Branch in Poland - an international automotive financial services company that provides a broad range of financial services to private and corporate clients, such as credit, leasing and insurance to the local market.

Haitong Bank's team involved in this transaction included Tomasz Wirth, Katarzyna Chrustek and Sylwia Jaroszek with a strong support of the Credit and Risk Management and Legal Departments.

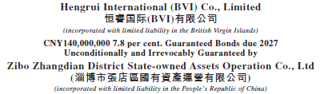

7.8% Bonds due 2027

Haitong Bank's Macau Branch acted as the Sole Global Coordinator, Joint Lead Manager and Joint Bookrunner of Hengrui International (BVI) Co., Limited's CNY 140 million tap bond issue, with a coupon of 7.8% due 2027 with guarantee by Zibo Zhangdian District State-owned Assets Operation Co., Ltd. (to be consolidated and form a single series with the CNY150,000,000 7.8 per cent. Guaranteed Bonds due 2027 issued by the Issuer on 5 January 2024).

The net proceeds from the Bonds are intended to be used for project construction and replenishing working capital.

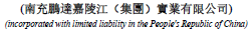

4.8% Bonds due 2027

Haitong Bank's Macau Branch acted as Joint Lead Manager and Joint Bookrunner of Nanchong Pengda Jialing River (Group) Industrial Co., Ltd.'s CNY 694.52 million bond issue, with a coupon of 4.8% and a 3-year tenor with SBLC by Bank of Tianjin Co., Ltd.

The net proceeds from the Bonds are intended to be used for refinancing existing offshore indebtedness.