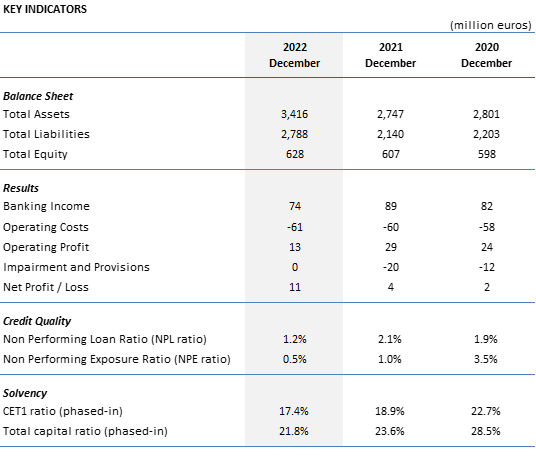

Haitong Bank reports a 2022 Net Profit of €11.1 million, a threefold increase versus a Net Profit of €3.6 million in 2021.

The Bank successfully managed the challenging backdrop in 2022. The year was marked by the war in Ukraine, increasing market volatility, inflation and interest rates. The lockdowns in China throughout the year affected China-related business, particularly in the first half of the year.

After the uncertainties experienced in 1H2022, business activity showed a significant improvement during 2H2022, with the important contribution from Fixed Income and M&A, resulting from the upturn in the Brazilian fixed income activity and from the increasing flow of China-related business. The Bank’s Macau Branch and the recently established Representative Office in Paris started to deliver on its business origination role. Total Banking Income for the year was €74 million, 17% lower than the €89 million reached in 2021, particularly explained by the slower first half of the year.

Operating Costs slightly increased, year-on-year, and amounted to €61 million. The Bank’s strict cost discipline allowed Operating Profit in 2022 to reach €13 million, despite subdued net revenues.

Total Assets showed an encouraging expansion of 24% reaching €3.4 billion by the end of 2022. Despite the more prudent risk appetite, the Loan Portfolio increased 24% to €772 million, driven by the strong dynamic of the Structured Finance business.

The Bank has also taken further steps to diversify its funding sources, increasing the maturity and reducing the cost of funding. In 2022, Haitong Bank launched two inaugural bond issues: in February, the Bank issued a 3-year €230 million senior notes and in May launched a 5-year USD 150 million fixed rate bond issue. Both issues were rated BBB by S&P, benefiting from a guarantee of Haitong Securities Co. Ltd..

Regarding Asset Quality, the Bank showed, once again, record indicators in 2022 expressed by the NPL and NPE ratios of 1.2% (2.1% in 2021) and 0.5% (1.0% in the previous year) in 2022, respectively.

The Bank has been executing a consistent strategy over the past few years, focused on strengthening its domestic client franchise in Europe and Latin America, alongside a recurrent cross-border business flow with China. The resilience shown during the last 3 years proves the efficiency of the Bank’s business model and positions the Bank favourably to take advantage of future growth opportunities in the next step of its development.