2020 Performance Highlights

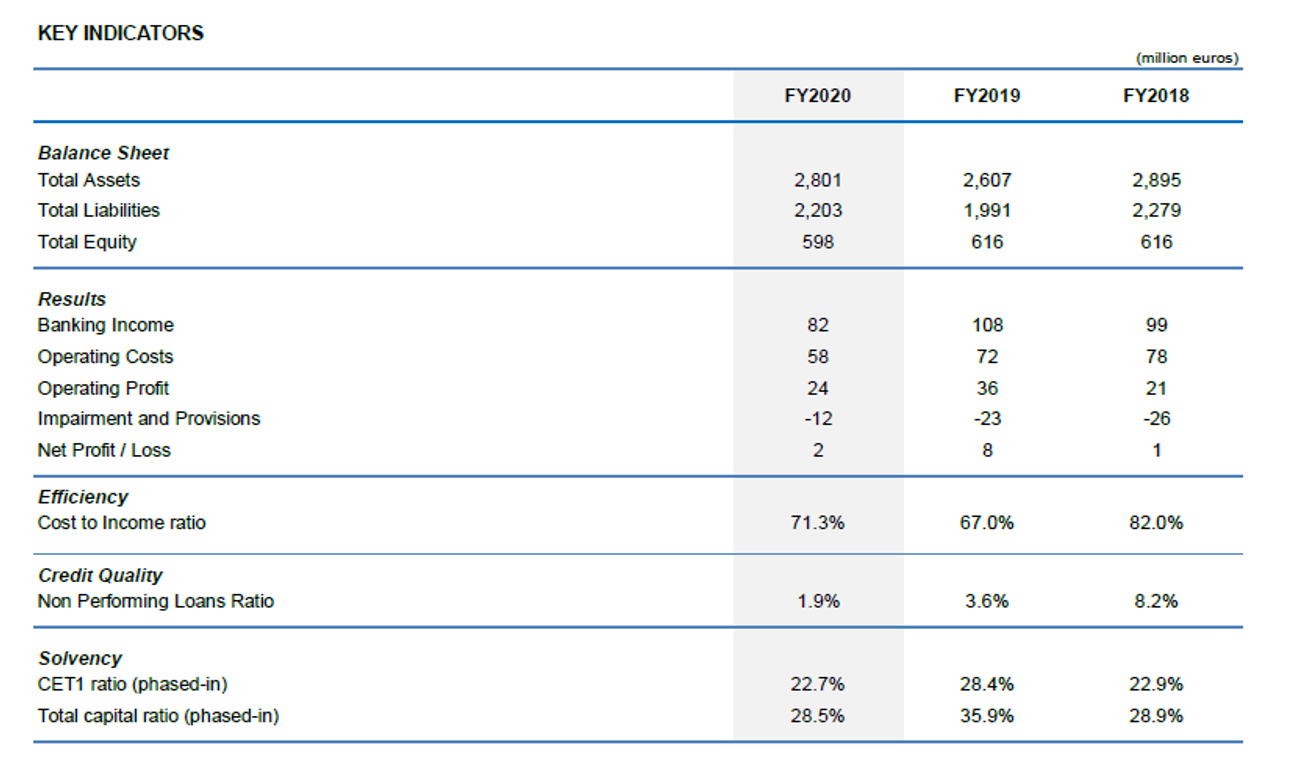

- Net Profit: Break-even goal reached, with a Net Profit in 2020 of EUR 1.6 million

- Operating Performance: 20% decrease of the Operating Costs to EUR 58 million, leading to a solid Operating Income of EUR 24 million

- Banking Income: €82 million in 2020, showing a strong recovery from the EUR 24 million generated in the first half of 2020

- Asset quality: Further improvement in the NPL ratio, down from 3.6% in 2019 to 1.9% in 2020

- Capital position: strong capital and liquidity positions with a CET1 ratio of 22.7% and a Total Capital Ratio of 28.5% as at end 2020, as well as an NSFR of 157%

- Consolidated business franchise in Europe, Latin America and China

Financial Overview

Haitong Bank, S.A. (Haitong Bank) reports a 2020 Net Profit of €1.6 million vs. a Net Profit of €7.5 million in 2019. This performance shows a good level of resilience to the impacts of COVID- 19 due to the nature of the Bank’s corporate and institutional business.

Despite the extremely adverse circumstances, Total Banking Income for the year was EUR 82 million, showing a strong recovery from the EUR 24 million generated in the first half of 2020. As the Bank maintained a strict cost awareness, Operating Costs decreased by almost 20% to EUR 58 million, leading to a solid Operating Income of EUR 24 million.

The Bank has also made further progress in 2020 regarding Asset Quality, with the NPL ratio decreasing from 3.6% in December 2019 to 1.9% in December 2020.

The Bank has been executing a consistent strategy over the last three years, focused on strengthening its domestic client franchise in Europe and Latin America, alongside a recurrent cross-border business flow with China. This unique business model position the Bank as a strategic driver of Haitong Group's international expansion beyond Asia-Pacific.

Capital

Haitong Bank continues to show strong capital and liquidity positions with a CET1 ratio of 22.7% and a Total Capital of 28.5% as at end 2020, giving the Bank further room to increase the size of its Balance Sheet to support clients' business in credit transactions, bond underwriting, hedging solutions, and Fixed Income products.